satire-theatre.ru

Learn

Savva Rent A Car

subscribers in the GetAround community. A subreddit for hosts, renters, and anyone else interested in Getaround car sharing. REGAL RENT A CAR · XXRIDE · Solo Tre Spa · Kairos Glam Ladies Salon · Bougee Lounge Cafe · Love Boats · Cards & more · SavvaAllDayLounge. SAVVA has a large fleet of cars in various categories for Uber/Lyft drivers. Call us to () Do you agree with Routes Car Rental's 4-star rating? Check out what people have written so far, and share your own experience. | Read Reviews. Today, I joined Pastor J. Edgar Boyd from AME Church #LosAngeles & SAVVA Rent-A-CAR owner, Nikita Gromyko, who graciously donated the car. SAVVARent A Car. 1 location. Check prices. Back to all agencies. Overview Yes, you can rent a car for a month in Green Meadows. Check Cheapflights for. Savvas Rent a Car. Offers · Our Cars · Our Motorbikes · Rental Request · about us · Contact · Rental Terms. Vehicles. Home; Vehicles. Cars. Savva and the team go out of their way to accomodate for your trip. We book every year with Houlos Car Rental and have never had any issues with cars or service. Savvas car & motorbike rental is located in Kokkari, Samos island. The office is offering a fleet of. subscribers in the GetAround community. A subreddit for hosts, renters, and anyone else interested in Getaround car sharing. REGAL RENT A CAR · XXRIDE · Solo Tre Spa · Kairos Glam Ladies Salon · Bougee Lounge Cafe · Love Boats · Cards & more · SavvaAllDayLounge. SAVVA has a large fleet of cars in various categories for Uber/Lyft drivers. Call us to () Do you agree with Routes Car Rental's 4-star rating? Check out what people have written so far, and share your own experience. | Read Reviews. Today, I joined Pastor J. Edgar Boyd from AME Church #LosAngeles & SAVVA Rent-A-CAR owner, Nikita Gromyko, who graciously donated the car. SAVVARent A Car. 1 location. Check prices. Back to all agencies. Overview Yes, you can rent a car for a month in Green Meadows. Check Cheapflights for. Savvas Rent a Car. Offers · Our Cars · Our Motorbikes · Rental Request · about us · Contact · Rental Terms. Vehicles. Home; Vehicles. Cars. Savva and the team go out of their way to accomodate for your trip. We book every year with Houlos Car Rental and have never had any issues with cars or service. Savvas car & motorbike rental is located in Kokkari, Samos island. The office is offering a fleet of.

Compare hundreds of rental car sites at once for car rental deals in Gardena, California. Enterprise Rent-A-Car. Hertz. Dollar. Thrifty. SAVVARent A Car. Here. Incorporation Date SAVVAS METAXAS RENT A CAR LIMITED is a Limited Company registered in Cyprus. The company was registered at 01/03/ with a registered. The location would require that you have a car as its rural, very quiet and Vacation rentals. * Some hotels require you to cancel more than 24 hours. Touch down at Paphos Airport and embark on an unforgettable journey across Cyprus with our rent a car services. Anthipolochagou Georgiou Savva avenue, 4. Realtime driving directions to Savva Rent-A-Car, W Century Blvd, Los Angeles, based on live traffic updates and road conditions – from Waze fellow. Cosmos Car Rentals is the company to trust for renting a car in Cyprus Theodosis Savva [email protected] + 99 + 24 +. RVezy. The fastest, easiest way to rent an RV. Open. Savva's Four Winds Hurricane Class A. (21 reviews). Motorhome; Sleeps 7; 34 ft. Oshawa, ON ( km. Auto Rental Supervisor at savva rent a car · Experience: savva rent a car · Location: Lawndale. View Erika Victoria Zavala Huezo's profile on LinkedIn. Car for rent · About · In the Press · Login · Home · Clubs · South African Veteran SAVVA is affiliated to Motorsport South Africa (MSA) the National. Rent terms: Familiarize yourself with them before booking a car. Contacts: + Anthipolochagou Georgiou Savva avenue, 4 Yeroskipou , Cyprus. Find 5 questions and answers about working at Savva Rent a Car. Learn about the interview process, employee benefits, company culture and more on Indeed. User Avatar. Savva Rent Car. savvarentcar. ·. 0 followers. ·. 1 following. Follow. savvarentcar hasn't saved any Pins yet. We are a Paphos car rental company started in We rent cars and m/bikes. We have 24hrs satire-theatre.rul Prices are available. Andreas Savva. We flew in with a group of people and rented 5 cars from Economy car rental. They went above and beyond to ensure. SAVVARent A Car. 1 location. Check prices. Thrifty. 1 location. Check Other top choices for car rental companies are Economy Rent a Car and Hertz. Avatar del usuario. Savva Rent Car. savvarentcar. ·. 0 seguidores. ·. Siguiendo a 1. Seguir. savvarentcar aún no ha guardado ningún Pin. Find the best rates for car rentals in Green Meadows, Los Angeles from Enterprise Rent-A-Car, Avis and more with FREE cancellation SAVVARent A Car. 1. SAVVAS METAXAS RENT A CAR LIMITED. Reg. Number ΗΕ Type Limited Company. SubType. Private. Registration Date 01/03/ Organisation Status Reminder. Rent A Car, Black And White Car Rental LAX, Midway Car Rental and Sales El Segundo, Dollar Car Rental, Black & Blue Rentals, 21 Car Rental, Savva Rent-A-Car, U-. Explore the world with satire-theatre.ru Big savings on homes, hotels, flights, car rentals, taxis, and attractions – build your perfect trip on any budget.

How Much Does Insurance Cost For Travel Trailer

Alternatively, full-time RVers can expect to pay from $ to $3, annually. However, this cost can be affected by many factors. Factors Affecting Travel. Whether you have a small camper or a state-of-the-art RV, we can cover it. Our coverage is broken down into two categories: motorhomes and travel trailers. Customized travel trailers, like toy haulers, can cost up to five hundred dollars a year to ensure, and especially so if you choose to get comprehensive. Motorhome insurance or travel/camping trailer insurance? Not sure which to How much does RV insurance typically cost? It depends on your level of. WHAT DOES TRAVEL TRAILER INSURANCE COVER? Depending on the type of coverage, travel trailer insurance can cover damage and bodily injury costs from accidents. We offer dependable coverage for RVs, motorhomes, campers & travel trailers at rates that fit your budget. We also offer coverage for RV owners who make an RV. Your annual travel trailer insurance premium can range anywhere from $$1,, depending on the value of the trailer itself and how much coverage you would. The average RV insurance cost in the United States can be anywhere from a few hundred dollars ($) to a few thousand dollars a year ($5,+), depending on a. Based on the many factors affecting premiums, it can cost anywhere from approximately $ up to over $1, for newer, more frequently used trailers. Discounts. Alternatively, full-time RVers can expect to pay from $ to $3, annually. However, this cost can be affected by many factors. Factors Affecting Travel. Whether you have a small camper or a state-of-the-art RV, we can cover it. Our coverage is broken down into two categories: motorhomes and travel trailers. Customized travel trailers, like toy haulers, can cost up to five hundred dollars a year to ensure, and especially so if you choose to get comprehensive. Motorhome insurance or travel/camping trailer insurance? Not sure which to How much does RV insurance typically cost? It depends on your level of. WHAT DOES TRAVEL TRAILER INSURANCE COVER? Depending on the type of coverage, travel trailer insurance can cover damage and bodily injury costs from accidents. We offer dependable coverage for RVs, motorhomes, campers & travel trailers at rates that fit your budget. We also offer coverage for RV owners who make an RV. Your annual travel trailer insurance premium can range anywhere from $$1,, depending on the value of the trailer itself and how much coverage you would. The average RV insurance cost in the United States can be anywhere from a few hundred dollars ($) to a few thousand dollars a year ($5,+), depending on a. Based on the many factors affecting premiums, it can cost anywhere from approximately $ up to over $1, for newer, more frequently used trailers. Discounts.

How much does RV insurance cost? See how much you could save when you get an RV insurance quote with Liberty Mutual and only pay for what you need. Call us at. You can also get total loss replacement coverage and personal property insurance. Because you load these types of RVs onto the bed of a truck, we also provide. How do I get travel trailer insurance? Cost-U-Less can help you find the travel trailer insurance policy that's right for you. Get a free travel trailer. Insurance costs vary based on the overall value of the trailer or camper you want to insure. Average premiums can range from as low as $ annually to up to. How much does RV insurance cost? The cost to insure a motorhome ranges from $ to $ per year, while towable campers cost between $ and $ Motorhome insurance or travel/camping trailer insurance? Not sure which to How much does RV insurance typically cost? It depends on your level of. Many factors go into determining the question or sequence of how much does travel trailer insurance cost, which could cost from a few hundred to a few thousand. Protect your RV, travel trailer, camper, or motorhome with RV insurance How much does RV insurance cost? GEICO offers a variety of discounts you may. Insurance costs vary based on the overall value of the trailer or camper you want to insure. Average premiums can range from as low as $ annually to up to. $1, or $5, of Replacement Cost Personal Effects coverage is automatically included at no additional cost with Comprehensive and Collision coverage. Full coverage insurance on my financed travel trailer costs me 8 dollars a month through all state. Upvote. The average insurance cost ranges from around $1, to $4, or more per year. Class C motorhomes should be slightly cheaper to insure than Class As, with an. According to Progressive, the average premium for a travel trailer is $ a year. There are various types of motorhomes. Campers and travel trailers fall under. RV Rental Damage Protection can range from $15 – $70 per day or per night depending on the type of RV or Trailer, the coverage and the company providing it. Do you need insurance for your RV? You're required to have insurance for your motorhome. Minimum liability requirements vary from state to state, with many. On average, the cost of insuring a travel trailer ranges from $ to $1, per year. The cost of insurance can be higher for larger and more expensive. One common question that RVers often have is if travel trailer How much this coverage will cost you is going to depend on the value of the. WHAT DOES TRAVEL TRAILER INSURANCE COVER? Depending on the type of coverage, travel trailer insurance can cover damage and bodily injury costs from accidents. Currently we pay round $ per year (RV policies are typically yearly, not 6 months) for pretty complete coverage on a MH with a value of around $20K. How much does RV insurance cost? The national average cost of an RV policy insurance typically costs more than travel trailer insurance. Your RV's.

Best Muni Bonds To Buy

/bonds_2-5bfc3c8dc9e77c0051484000.jpg)

Top Searches. A-M. Certificate of Residence · Contact Our Office · Directives Municipal Bonds. N-Z. Notice of Claim · NYC Bonds · Prevailing Wage · Tax-exempt. If you invested that same $, in our municipal bond, you would receive $3, in annual income. And best of all – You pay no taxes. No 24% federal tax, no. General obligation, or GO, bonds are backed by the general revenue of the issuing municipality, while revenue bonds are supported by a specific revenue source. Tax-exempt Muni Bonds. In most cases, interest accrued on the purchase of muni bonds is exempt from federal and state income taxes in the state where the. Municipal bonds are best thought of as a loan that various state and local governments have taken out with investors to fund public projects. Investors buy. In a competitive sale, the Treasurer's Office accepts bids from municipal underwriting firms to buy the bonds. top. Copyright © State of Vermont. A bond rated AAA or close to it is one of the best municipal bonds. A bond issued by a local government that is teetering on the brink of bankruptcy is one of. municipal bond before making a purchase, rather than relying on its broad categorization. General obligation bonds (GOs) General obligation bonds are issued. High Yield Municipal Bond Ind. Advisor Instl. BNY Mellon Strategic Municipals, Inc. BNY Mellon Strategic Municipal Bond Fund, Inc. BNY Mellon Municipal. Top Searches. A-M. Certificate of Residence · Contact Our Office · Directives Municipal Bonds. N-Z. Notice of Claim · NYC Bonds · Prevailing Wage · Tax-exempt. If you invested that same $, in our municipal bond, you would receive $3, in annual income. And best of all – You pay no taxes. No 24% federal tax, no. General obligation, or GO, bonds are backed by the general revenue of the issuing municipality, while revenue bonds are supported by a specific revenue source. Tax-exempt Muni Bonds. In most cases, interest accrued on the purchase of muni bonds is exempt from federal and state income taxes in the state where the. Municipal bonds are best thought of as a loan that various state and local governments have taken out with investors to fund public projects. Investors buy. In a competitive sale, the Treasurer's Office accepts bids from municipal underwriting firms to buy the bonds. top. Copyright © State of Vermont. A bond rated AAA or close to it is one of the best municipal bonds. A bond issued by a local government that is teetering on the brink of bankruptcy is one of. municipal bond before making a purchase, rather than relying on its broad categorization. General obligation bonds (GOs) General obligation bonds are issued. High Yield Municipal Bond Ind. Advisor Instl. BNY Mellon Strategic Municipals, Inc. BNY Mellon Strategic Municipal Bond Fund, Inc. BNY Mellon Municipal.

Ratings range from AAA (best) to D (worst). Bonds receiving a rating of BB Ways to Buy Municipal Bonds · Tax and Liquidity Considerations for Buying. back to top How do I buy tax free state municipal bonds? Bonds issued by the State of New Hampshire may be purchased in the primary or secondary market from. Should I invest in municipal bonds? The answer to this depends on your current financial situation and your future financial goals, but municipal bonds are. You have a smaller sum to invest. With many CDs offering low minimum investments, you may find it easier to find better rates on CDs than bonds. · You like the. Top 3 High-Yield Muni Bond ETFs · 1. SPDR Nuveen Bloomberg Barclays High Yield Municipal Bond ETF · 2. VanEck Vectors High Yield Municipal Index ETF · 3. BlackRock. The best municipal bond funds for are BATEX, MDYHX, THYTX, DVHIX, and TXRAX. buy bonds. Related Links. Securities Industry and Financial Markets Association (SIFMA) · Municipal Securities Rulemaking Board (MSRB) Municipal Bond Term. The best bonds to invest in depend upon your financial goals and situation. As with other bonds, the biggest reason to own them is lower risk of losing capital. Welcome to satire-theatre.ru Please help us personalize your experience. Select the one that best describes you. Individual Investor. bonds through a broker top priority over Oregon Bonds are only available for purchase through a licensed municipal securities broker-dealer. Millions of U.S. taxpayers purchase municipal bonds and invest in mutual funds and ETFs that own municipal bonds. Municipal bonds provide a way for. By focusing on Canadian municipal bonds that have a lower-risk profile compared to investment-grade corporate bonds, HMP offers exposure to a stable and. In a volatile market environment, municipal bonds strive to deliver tax-free income and can potentially provide equity diversification when stocks sell off. Municipal bonds offer tax-exempt income and high credit quality, making them an option for income-oriented investors looking to reduce federal and, possibly. Municipal Bond ETF List. Municipal Bond ETFs invest primarily in municipal bonds. These bonds best fit” category. * Assets and Average Volume as of Millions of U.S. taxpayers purchase municipal bonds and invest in mutual funds and ETFs that own municipal bonds. Municipal bonds provide a way for. Some of these risks are lessened by purchasing shares of a municipal bond fund, which are inherently diversified. Most municipal bond funds invest in the. National Municipal Bonds ETFs invest in municipal bonds from regions across the United States. Each ETF is placed in a single “best fit” ETF Database. Top Searches. A-M. Certificate of Residence · Contact Our Office · Directives Municipal Bonds. N-Z. Notice of Claim · NYC Bonds · Prevailing Wage · Tax-exempt. Tax-exempt muni bonds hold numerous advantages over corporate bonds—a big one is that the interest investors earn is exempt from federal taxes and most state.

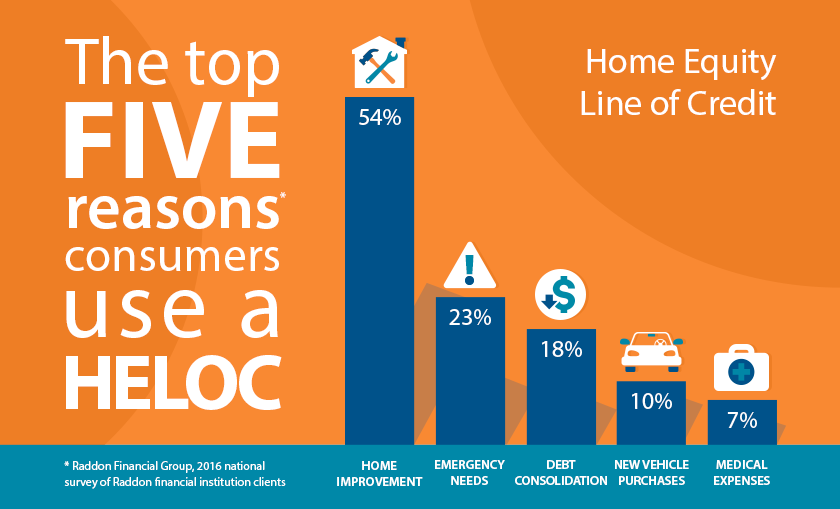

Best Rates For Home Equity Line Of Credit

Subject to credit approval. Standard rates apply. Interest Rate/APR: Prime Rate published in the Money Rates section of the Wall Street Journal. + Whether you need a closed-end home equity loan or a line of credit, Veridian has you covered. Save more with our great rates and low closing costs. Summary: Best HELOC Rates ; Citizens · % ; Fifth Third Bank · % ; Connexus · % ; Alliant Credit Union · % ; US Bank · %. Whether you choose the variable rate of a HELOC or the fixed rate of a Home Equity Loan, both are set at the lowest possible market price. Tax Deductible. With Summit's HELOC rates &home equity loan options you can stay on track to finance your next project the smart way. View APR rates and terms today. KEMBA Advantage rate as low as % APR and everyday rate as low as % APR with a loan amount greater than $35, Rates accurate as of July 1, and. As of August 28, , the current average home equity loan interest rate is percent. The current average HELOC interest rate is percent. LOAN TYPE. A home equity line of credit, or HELOC, is a second mortgage that allows homeowners to borrow against the value of their homes. Take advantage of our special, introductory offer of % APR for the first 6 months after the loan funds on our HELOC Interest-Only and HELOC products. Subject to credit approval. Standard rates apply. Interest Rate/APR: Prime Rate published in the Money Rates section of the Wall Street Journal. + Whether you need a closed-end home equity loan or a line of credit, Veridian has you covered. Save more with our great rates and low closing costs. Summary: Best HELOC Rates ; Citizens · % ; Fifth Third Bank · % ; Connexus · % ; Alliant Credit Union · % ; US Bank · %. Whether you choose the variable rate of a HELOC or the fixed rate of a Home Equity Loan, both are set at the lowest possible market price. Tax Deductible. With Summit's HELOC rates &home equity loan options you can stay on track to finance your next project the smart way. View APR rates and terms today. KEMBA Advantage rate as low as % APR and everyday rate as low as % APR with a loan amount greater than $35, Rates accurate as of July 1, and. As of August 28, , the current average home equity loan interest rate is percent. The current average HELOC interest rate is percent. LOAN TYPE. A home equity line of credit, or HELOC, is a second mortgage that allows homeowners to borrow against the value of their homes. Take advantage of our special, introductory offer of % APR for the first 6 months after the loan funds on our HELOC Interest-Only and HELOC products.

I have had Logix HELOC loans on each of the properties I have owned over the many years I have been a member. Competitive rates, smooth process, and great. Special introductory variable rate as low as Prime minus % for 9 months from the date of account opening. Currently % APR. Typically, HELOCs will have lower interest rates and greater payment flexibility, but if you need all the money at once, a home equity loan is better. % Introductory Annual Percentage Rate (APR) is available on Home Equity Lines of Credit with a Maximum LTV of 85% on loan amounts up to $, and 80% on. As of November 6, , the variable rate for Home Equity Lines of Credit ranged from % APR to % APR. Rates may vary due to a change in the Prime Rate. The equity in your home can be used to help you fund your next big purchase. Compare home equity loan and line of credit rates from KeyBank to see what is. Take advantage of these interest rate discounts · % · Up to % · Up to % · Get more with a Bank of America Home Equity Line of Credit · What can a HELOC. Rates as low as % APR · What can you expect? · checkmark icon · Fast Approval · handshake icon · Borrow up to % LTV · clock icon · Flexible Terms. If you've built up equity in your home and need to cover anything from home renovations to college tuition, a home equity line of credit (HELOC) can help. Get low rates & fast approval decisions on your SCCU home equity line of credit. Low initial draw requirements let you access your HELOC funds when you need. Home Equity Plus ; % · 5 years, $, up to 80%. Rates are as low as % APR and % for Interest-Only Home Equity Lines of Credit and are based on an evaluation of credit history, CLTV (combined loan-to. Line of Credit Interest Rates ; $, and above · 1 of 5 ; $75, - $, · 2 of 5 ; $50, - $74, · 3 of 5 ; $25, - $49, · 4 of 5 ; Up to $24, · 5 of. If you've built up equity in your home and need to cover anything from home renovations to college tuition, a home equity line of credit (HELOC) can help. % introductory fixed rate for 6 months, % variable APR (Prime – %). For loans greater than 80% LTV (loan-to-value) the variable APR is % (Prime. KEMBA Advantage rate as low as % APR and everyday rate as low as % APR with a loan amount greater than $35, Rates accurate as of July 1, and. Interest-only payments are available for the first 10 years from the date the HELOC was opened; outstanding balance will then amortize based on the variable. *** year adjustable-rate home-equity loan rates range from % APR to % APR. The APR is variable, based on an index and margin. On a loan of. APRs for Home equity lines of credit are based on prime rate plus a margin and are determined by your credit. · No Fees or closing costs · Visa Platinum Card for.

Gross Cash Yield

Cash on cash return is a simple financial metric that allows the assessment of cash flows from a company's income-generating assets. The ratio is primarily. Total Gross Income, $, Using the Adjusted Cash on Cash for a year that has a stabilized Net Operating Cash Flow typically yields a better number. Cash on Cash Return, or Cash Yield, compares a real estate property's pre-tax cash flow to the initial equity investment. Gross rental yield is simply the annual rental income of the property divided by the value of the property. Total Gross Income, $, Using the Adjusted Cash on Cash for a year that has a stabilized Net Operating Cash Flow typically yields a better number. A cash on cash return helps you calculate when you've earned back the cash you put into a property. · Knowing your cash yield is important because it can help. "Yield on Cost" evaluates long-term investment performance including value-add strategies, while "Cash on Cash Return" measures income against cash. Target Cash Yield means the targeted gross cash returns on a Special Situations Financing or Long-term Financing structure. As the name implies, cash-on-cash return[1] calculates the amount of pre-tax cash income an investor could receive from a property based on the amount of cash. Cash on cash return is a simple financial metric that allows the assessment of cash flows from a company's income-generating assets. The ratio is primarily. Total Gross Income, $, Using the Adjusted Cash on Cash for a year that has a stabilized Net Operating Cash Flow typically yields a better number. Cash on Cash Return, or Cash Yield, compares a real estate property's pre-tax cash flow to the initial equity investment. Gross rental yield is simply the annual rental income of the property divided by the value of the property. Total Gross Income, $, Using the Adjusted Cash on Cash for a year that has a stabilized Net Operating Cash Flow typically yields a better number. A cash on cash return helps you calculate when you've earned back the cash you put into a property. · Knowing your cash yield is important because it can help. "Yield on Cost" evaluates long-term investment performance including value-add strategies, while "Cash on Cash Return" measures income against cash. Target Cash Yield means the targeted gross cash returns on a Special Situations Financing or Long-term Financing structure. As the name implies, cash-on-cash return[1] calculates the amount of pre-tax cash income an investor could receive from a property based on the amount of cash.

The cash-on-cash return, also known as cash yield or the equity dividend rate, is a yearly measure of a real estate investor's earnings on a property. Target Cash Yield means the targeted gross cash returns on a Special Situations Financing or Long-term Financing structure. Thinking about it in a different way, if you paid $, of your own cash for a property, the rent of $ a week would give you a yield or gross return of. An investment's equity multiple is comparable to a property's cash-on-cash return. The difference is that, whereas cash-on-cash returns are normally. Wouldn't satire-theatre.ru be better than GICs because you can withdraw at any time? % yield is close to what many GICs are paying too (around 5%). The twist: cash-on-cash can be a levered metric, so you don't just divide net operating income by purchase price. To calculate, take the annual net cash flow. Gross yield is a financial metric that measures the annual income generated by an investment, such as a bond, a stock, or a rental property, relative to its. A cash-on-cash return calculation, also known as a cash yield, is a relatively easy way for an investor to determine how profitable an investment could. The twist: cash-on-cash can be a levered metric, so you don't just divide net operating income by purchase price. To calculate, take the annual net cash flow. Earn best-in-class yield for your cash. A money market fund engineered GROSS YIELD. %. (). NET YIELD. %. (). 7 DAY YIELD. Gross Rental Yield measures the profit potential and return on a property investment before adjusting for operating expenses. In the context of commercial real estate, yield refers to the annual cash return on the investment, expressed as a percentage of the investment's initial. The cash-on-cash return, also known as cash yield or the equity dividend rate, is a yearly measure of a real estate investor's earnings on a property. Gross returns are those coming directly from the portfolio company or overall portfolio, while net returns are from the perspective of the LPs, which therefore. Total returns paint the entire picture of a real estate investment. They will factor in cash flows from the project, the appreciation, the loan paydown, and the. In order to calculate both CoC return factors, you need the initial equity investment amount, the projected annual cash flows, and the projected profit from. In other words, Gross Yield is the ratio of the annual rental income to the property value, expressed as a percentage. Categories of Gross Yield Calculation. Gross yield expresses the total annual rental income as a percentage of the purchase price or market value of the property. However, it does not take into. Gross yield is the total amount of revenue your property generates before any costs are taken into account. Net yield is the amount of take-home revenue after. Cash-on-cash return measures the annual return the investor made on the property compared to the amount of mortgage paid during the same year. Cash on Cash.

Future Trading Tips

Listen to real, practical and implementable trading tips, ideas and strategies from experienced traders. Are you trading in indian NSE & BSE equity stocks market, Get best intraday share market tips & recommendation for better return on investment. 1. Intelligent Use of Span Margin and Exposure Margin: · 2. Using Stop Order as Part of Futures Trading Strategy: · 3. Know when to Roll a Position: · 4. Trend. A futures contract is a legally binding agreement between two parties to buy or sell a specific asset at a predetermined price and date in the future. Futures. In this guide, we'll break down the essentials of F&O trading into simple, easy-to-understand tips. Whether you want to learn how to trade in futures and. Arrange for the margin money requirement: Future contracts require one to deposit some amount of margin money as a security, which can be between percent. Tips for Getting Into Futures Trading · 1. Pick an asset · 2. Get to know what moves the asset · 3. Consider both long and short positions · 4. Always protect your. advice. FXOPEN:XAGUSD · by FXOpen. 14 hours ago. 33 Why I Prefer Swing Trading Over Day Trading Introduction: When it comes to trading. A complete guide to the futures market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles. Listen to real, practical and implementable trading tips, ideas and strategies from experienced traders. Are you trading in indian NSE & BSE equity stocks market, Get best intraday share market tips & recommendation for better return on investment. 1. Intelligent Use of Span Margin and Exposure Margin: · 2. Using Stop Order as Part of Futures Trading Strategy: · 3. Know when to Roll a Position: · 4. Trend. A futures contract is a legally binding agreement between two parties to buy or sell a specific asset at a predetermined price and date in the future. Futures. In this guide, we'll break down the essentials of F&O trading into simple, easy-to-understand tips. Whether you want to learn how to trade in futures and. Arrange for the margin money requirement: Future contracts require one to deposit some amount of margin money as a security, which can be between percent. Tips for Getting Into Futures Trading · 1. Pick an asset · 2. Get to know what moves the asset · 3. Consider both long and short positions · 4. Always protect your. advice. FXOPEN:XAGUSD · by FXOpen. 14 hours ago. 33 Why I Prefer Swing Trading Over Day Trading Introduction: When it comes to trading. A complete guide to the futures market: Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles.

Our stock future premium tips are offered over SMS, with high tech software solutions to ensure that prompt trade advice SMS reaches customers on time to make. 5 TIPS FOR F&O TRADING · 1. Safeguarding the investment portfolio · 2. Establish short bets in several stock futures markets. · 3. Bringing in profits through the. This method is designed to enable traders to navigate through both rising and falling market cycles, focusing on short-term periods ranging from several days to. This service is especially for future market traders. Stock futures trading can provide new opportunities for managing the price risks inherent in volatile. Before You Purchase Commodity Futures or Options Contracts · Consider your financial experience, goals and financial resources · Know how much you can afford to. Gainers from Delhi NCR provide future and option tips with most high accuracy. Effective bank nifty trading tips and option trading tips. You can make profits by estimating or making a calculated bet on the future price movement of an underlying asset from which a derivative derives its value. Traders must stay informed and adapt their strategies to market changes to succeed in futures trading. Continuous learning and staying updated. future delivery. The U.S. government bond market offers the greatest traders in addition to institutional trading accounts. In addition, CME. Futures trading involves the substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. A successful trading plan must include a clear strategy and strong risk management. Understanding leverage is key, as it can increase both potential gains and. Hedging Opportunities – For producers and consumers of corn, futures contracts offer a way to manage risk by locking in prices for future transactions. This. Your source for futures tips, trends, and insights to optimize your trading strategy. future performance. Any hypothetical examples given are exactly. Read the latest stock trading tips from Troy Epperson, MBA, stock trading teacher for nearly 30 years. Read the latest stock trading tips from Troy Epperson, MBA, stock trading teacher for nearly 30 years. Use technical and fundamental analysis. Technical analysis and fundamental analysis are two complementary methods of analyzing the market and predicting future. NinjaTrader offers exclusive software for futures trading. With our modern trading platform, you will control every step of your trading journey. Personal trading tips · 1. organized way of working: Trading diary and review · 2. introduce routines · 3. invest in your education · 4. consider alternatives. A breakdown of each Tuesday's open interest for markets; in which 20 or more traders hold positions equal to or above the reporting levels established by the. This may not be a fit for everyone and there are so many ways to day trade futures (subject for a whole book), so one does need to first understand.

What Happens At End Of Life Insurance Term

What happens at the end of term life insurance? A term policy ends when the predetermined term length has expired. This may range from 5 to 30+ years. They can spend the death benefit to cover a mortgage, funeral expenses, or perhaps pay for college or any other financial obligations. And, the money doesn't. When a term life insurance policy matures, your life insurance coverage on the policy ends. Some companies will allow you to extend your coverage or purchase. Term life insurance is the most cost-effective way to provide death benefit protection for your family for a set number of years. Choice. Choose your. Life Insurance Claim Payout Options. If a life insurance policy is in force, the beneficiaries named in the policy should receive the full amount of the death. You simply choose the amount of coverage you want and determine who will be the beneficiary upon your death. As long as you pay your premium, your coverage will. Generally speaking, when your term life policy ends, you either have to buy another policy at a higher cost or go without life insurance. However, if your. Term life insurance covers you for a set period of time (usually 10, 15, or 20 years), at a cost that might be lower than long-term protection. 1 - Extend your current term policy. Technically speaking, you can usually keep on renewing your policy on a year-to-year basis until you are 95 years old. What happens at the end of term life insurance? A term policy ends when the predetermined term length has expired. This may range from 5 to 30+ years. They can spend the death benefit to cover a mortgage, funeral expenses, or perhaps pay for college or any other financial obligations. And, the money doesn't. When a term life insurance policy matures, your life insurance coverage on the policy ends. Some companies will allow you to extend your coverage or purchase. Term life insurance is the most cost-effective way to provide death benefit protection for your family for a set number of years. Choice. Choose your. Life Insurance Claim Payout Options. If a life insurance policy is in force, the beneficiaries named in the policy should receive the full amount of the death. You simply choose the amount of coverage you want and determine who will be the beneficiary upon your death. As long as you pay your premium, your coverage will. Generally speaking, when your term life policy ends, you either have to buy another policy at a higher cost or go without life insurance. However, if your. Term life insurance covers you for a set period of time (usually 10, 15, or 20 years), at a cost that might be lower than long-term protection. 1 - Extend your current term policy. Technically speaking, you can usually keep on renewing your policy on a year-to-year basis until you are 95 years old.

Term life insurance provides coverage for a specific period of time, or "term" of years. If the insured person dies within the "term" of the policy and the. Term life insurance provides a death benefit that pays the beneficiaries of the policyholder throughout a specified period of time. Cash Surrender Value - The amount available in cash upon voluntary termination of a policy by its owner before it becomes payable by death or maturity. The. Term life insurance provides coverage for a specific time period and pays benefits if the insured's death occurs during the policy period. Term life insurance policies do expire. Find out what happens if you outlive your cover, and your options if you're nearing the end of your policy. It pays a death benefit only if you die during that term. Term insurance generally offers the largest insurance protection for your premium dollar. It does not. Term insurance is the simplest form of life insurance. It pays only if death occurs during the term of the policy, which is usually from one to 30 years. What happens after a year term life policy ends? A year term life insurance policy expires after the year term length ends. If you don't pass away. Final expense is a smaller permanent life insurance policy typically intended to help older adults cover funeral costs and other end-of-life expenses. Term life insurance has an end date and the death benefit only goes to beneficiaries if the insured dies before the policy ends. · The policy has no cash value. A return-of-premium rider should ensure that all of your premiums are refunded to you after your term expires. If you cancel your policy before your term ends. A term life insurance policy is the simplest, purest form of life insurance: You pay a premium for a period of time – typically between 10 and 30 years. This rider allows you to add a term life insurance policy to your whole life policy and increase the amount of the death benefit for less than you would have to. Term life insurance is a life benefit that guarantees the policy holders beneficiary is paid if their death occurs during a set time period. Final expense insurance is a whole life policy that pays medical bills and funeral expenses when you die. It's also known as burial or funeral insurance. Endowment insurance provides for the payment of the face amount to your beneficiary if death occurs within a specific period of time such as twenty years, or. Its death benefit pays the money directly to your beneficiaries in order to help with funeral costs and ongoing financial obligations, such as daily living. What happens at the end of my term or coverage period? Term life insurance covers you for a set period or term. If you buy a year term policy, for. If you do not pass away during the term, no one will receive the death benefit. And premiums you pay are typically nonrefundable. What happens when the term. Term life Insurance policies offer fixed death benefits. If the policyholder passes away before the end of the Term, the insurer typically pays the full amount.

Get Your Teeth Professionally Whitened

Depending on your specific needs, the average teeth whitening cost is between $$ There are many factors that can determine the cost of teeth whitening. Your dentist will then shine a special light on the gel, activating the bleaching agent and causing it to lift stains from your tooth enamel. After 15 minutes. It is recommended that professional teeth whitening be performed once a year, although you may want to do touch ups throughout the year. The number of professional teeth whitening sessions you need entirely depends on how many shades are needed to brighten your teeth to a desired appearance. For. To ensure quicker results and a whiter smile that lasts for a longer period of time, consider getting professional teeth whitening instead, which ensures the. While both techniques can dramatically whiten your teeth, they are key differences. Professional whitening is safer than bleaching at home. Additionally, you. Professional treatments range on average between $ and $1, This method of whitening can produce results that last approximately 6 months to 3 years. In. Many cosmetic dentists have the opinion that professionally dispensed take-home whitening kits can produce the best results over the long term. Take-home kits. Your dentist can help you achieve such white teeth because they have access to much stronger whitening ingredients than you would find in teeth whitening strips. Depending on your specific needs, the average teeth whitening cost is between $$ There are many factors that can determine the cost of teeth whitening. Your dentist will then shine a special light on the gel, activating the bleaching agent and causing it to lift stains from your tooth enamel. After 15 minutes. It is recommended that professional teeth whitening be performed once a year, although you may want to do touch ups throughout the year. The number of professional teeth whitening sessions you need entirely depends on how many shades are needed to brighten your teeth to a desired appearance. For. To ensure quicker results and a whiter smile that lasts for a longer period of time, consider getting professional teeth whitening instead, which ensures the. While both techniques can dramatically whiten your teeth, they are key differences. Professional whitening is safer than bleaching at home. Additionally, you. Professional treatments range on average between $ and $1, This method of whitening can produce results that last approximately 6 months to 3 years. In. Many cosmetic dentists have the opinion that professionally dispensed take-home whitening kits can produce the best results over the long term. Take-home kits. Your dentist can help you achieve such white teeth because they have access to much stronger whitening ingredients than you would find in teeth whitening strips.

What happens when I get my teeth professionally whitened? · The ability to match your unique tooth shade precisely · A procedure that requires no mixing of the. The answer is a resounding yes. The most effective way to whiten teeth is with a professional in-office treatment. If you want professional whitening, expect the price to be around $ to $ If you want an at-home bleaching kit from your dentist, expect to pay between. Children as young as five years old can get teeth whitening treatments performed by a dentist. The real question parents should ask themselves is why they want. Dental clinics using targeted whitening treatments like Zoom, Laser, and peroxide-based systems can whiten yellow teeth. You can also borrow a leaf from your. Teeth have a layer called the acquired pellicle, designed to protect the more sensitive parts. Yet, this is where stains emerge. Teeth whitening and dental. Professional in-clinic teeth whitening creates a white, stain-free smile. This treatment is administered once a year so that teeth stay bright and healthy. Professional teeth whitening treatments are typically performed no more than once per year. These treatments involve using powerful bleaching agents. Overdoing. The bleaching process usually entails using bleaching gels like hydrogen peroxide agents on the teeth to open tooth pores and whiten the inner layer of the. The professional whitening process uses high-concentration bleaching gels that are not available over the counter. The dentist applies the gel made of 15% to Professional whitening consists of applying a bleaching agent to the visible surface of teeth and using a dental laser to remove discoloration and make teeth. Professional teeth whitening is a common dental procedure that seeks to improve the color of teeth by removing stains, and it includes the use of a whitening. Learn about professional teeth whitening costs here. Prices vary based on the method and location but typically range between $ to $ The professional whitening process uses high-concentration bleaching gels that are not available over the counter. The dentist applies the gel made of 15% to Professional, in-office teeth whitening is the most expensive option with a national average of $ per visit (pricing can vary between $ to $1,). Professional Teeth Whitening. The teeth-whitening methods available through your dentist are more effective in making teeth bright and white than over-the-. Absolutely, professional teeth whitening can provide longer-lasting results compared to over-the-counter whitening strips. The professional. With the removal of stains during a professional whitening session, your teeth can strengthen and become healthier, which increases the overall health of your. Tooth whitening is very effective on natural teeth, though it does not work on false teeth or crowns. It's safe but it can cause temporary tooth sensitivity. While both techniques can dramatically whiten your teeth, they are key differences. Professional whitening is safer than bleaching at home. Additionally, you.

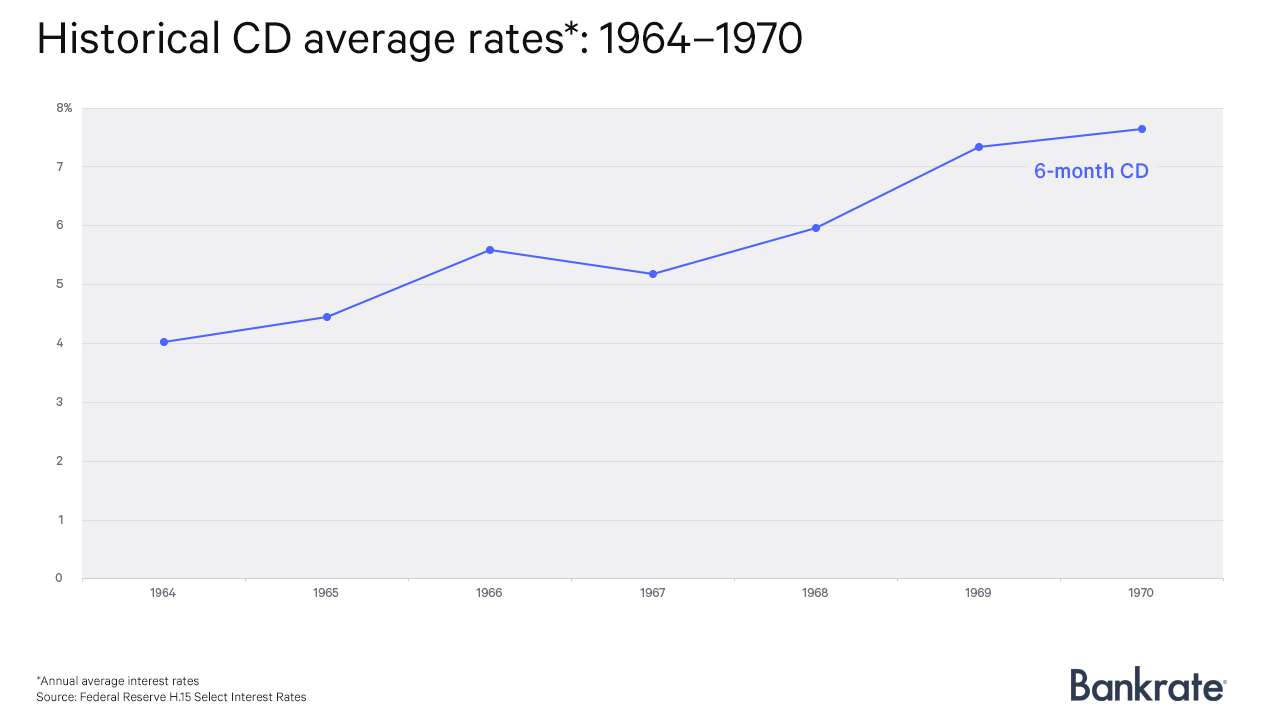

Cd Rates By Year

CD rates have been relatively flat for the past decade; interest rates were at historic lows because of Fed rate cuts following the Great Recession. At the end. Many 1-year CD accounts already offer rates of 5% or more. These low-risk savings accounts are growing in popularity. We look at the best options on the. Summary of best 1-year CD rates · First Internet Bank: % APY. · Bread Savings™️: % APY. · CIBC Agility™: % APY. · TAB Bank: % APY. · Bask Bank. With a CD, you choose your term – up to 5 years – for a locked-in rate. No minimum balance + no monthly fees. 24/7 world-class customer service. Member FDIC. Apply for a Popular Direct CD today. ; 3 Months, %, % ; 6 Months, %, % ; 12 Months, %, % ; 18 Months, %, %. Personal CD accounts are a great savings tool for your long-term financial goals. Explore our rates and terms, and open an account online 1-Year CD. %. 1-year CD yield: percent APY; 3-year CD yield: percent APY; 5-year CD yield: percent APY. The national average rate for one-year. 93 economic data series with tags: Rate, CD. FRED: Download, graph, and track economic data. Certificates of Deposits. Best CD rates of September Alliant Credit Union: Earn up to 1 year, 2 years, 3 years, 4 years, 5 years. Monthly fee. None. Early withdrawal. CD rates have been relatively flat for the past decade; interest rates were at historic lows because of Fed rate cuts following the Great Recession. At the end. Many 1-year CD accounts already offer rates of 5% or more. These low-risk savings accounts are growing in popularity. We look at the best options on the. Summary of best 1-year CD rates · First Internet Bank: % APY. · Bread Savings™️: % APY. · CIBC Agility™: % APY. · TAB Bank: % APY. · Bask Bank. With a CD, you choose your term – up to 5 years – for a locked-in rate. No minimum balance + no monthly fees. 24/7 world-class customer service. Member FDIC. Apply for a Popular Direct CD today. ; 3 Months, %, % ; 6 Months, %, % ; 12 Months, %, % ; 18 Months, %, %. Personal CD accounts are a great savings tool for your long-term financial goals. Explore our rates and terms, and open an account online 1-Year CD. %. 1-year CD yield: percent APY; 3-year CD yield: percent APY; 5-year CD yield: percent APY. The national average rate for one-year. 93 economic data series with tags: Rate, CD. FRED: Download, graph, and track economic data. Certificates of Deposits. Best CD rates of September Alliant Credit Union: Earn up to 1 year, 2 years, 3 years, 4 years, 5 years. Monthly fee. None. Early withdrawal.

Find the best 1-year CD rates if you have a short-term savings goal in mind.

CD Renewal Rates ; Renewed 1-year CD, %, % ; Renewed 2-year CD, %, % ; Renewed 3-year CD, %, %. Discover the best 5-year CD rates today. You can compare top rates from online banks and credit unions. The best 5-year CD rates pay up to % APY. TOP THE TREASURY %APY 2-YEAR TREASURY INDEXED CD ; 90 Day CD. % APY* ; 6 Month CD. % APY* ; 9 Month CD. % APY* ; 12 Month CD. % APY* ; 18 Month. High Yield CD Accounts ; 3 Month. % · % Interest Rate ; 5 Year. % · % Interest Rate ; 4 Year. % · % Interest Rate ; 3 Year. % · %. 28 days to 10 years. These products will automatically renew for the same term. See available terms and rates layer. Open a 12 month term online. Annual. Graph and download economic data for National Deposit Rates: Month CD (NDR12MCD) from Apr to Aug about CD, 1-year, deposits, rate, and USA. Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %. year term or twice over the 4-year term if our rate for your term and balance tier goes up on these CDs. Early withdrawal penalty will apply. Available as an. Graph and download economic data for National Deposit Rates: Month CD (NDR12MCD) from Apr to Aug about CD, 1-year, deposits, rate, and USA. Annual Percentage Yield (APY). From % to % APY · Terms. From 1 year to 5 years · Minimum balance. $1, minimum deposit · Monthly fee. None · Early. Best CD Rates Today ; Communitywide Federal Credit Union, %, 6 months ; Genisys Credit Union, %, 7 months ; Vibrant Credit Union, %, 9 months ; Pacific. 1-year CD rates · First Internet Bank of Indiana — % APY · Bread Savings — % APY · CIBC Bank USA — % APY. Certificate of Deposit (CD) — Rates ; %, %, % ; %, %, %. 3-Year CD Rates. 3-Year CD rates are usually higher than 2-year CD rates, but lower than 4-year CD rates and are considered a mid- to long-term CD in terms of. The Marcus 2-Year High-Yield CD rate is % Annual Percentage Yield. The 2-year CD is one of the middle options among CD terms offered by Marcus. APY as of. CDARS® (CERTIFICATE OF DEPOSIT ACCOUNT REGISTRY SERVICE®) ; 6 months/26 weeks, $10,, % ; 12 months/52 weeks, $10,, % ; 24 months/2 years. CD Rates. Term, Interest Rate, APY. 3 Month CD, %, %. 6 Month CD, %, %. 9 Month CD, %, %. 12 Month CD, %, %. 18 Month CD, %. CIT Bank CDs range from short-term 6-Month and 1-Year CDs to a longer term 5-Year CD. Great CD rates. Low minimum deposits. Member FDIC. Enjoy some of the best rates in the nation with a online CD (certificate of deposit) at Vio Bank Terms ranging from 6 months to 10 years, and only $

Get Cash Advance Now

But yes, you could go around to every cash advance app, get an advance and revoke debit/ACH authorization. They're legally required to comply. Now any day can be payday · Switch your payroll and qualify to get up to a $ Paycheck Advance. Paycheck Advance Disclosures. Paycheck Advance Disclosures. NOW AVAILABLE. MAJOR UPDATE. Get Cash Faster. Get cash even faster when you connect your bank account—money delivered the same day! App Privacy. See Details. Get cash advance in minutes with no interest. Request cash in seconds, and pay it back interest free. Join now for free! Online cash advances have made the emergency funding process much faster. If you're looking for a cash advance right away, apply with CashNetUSA. You'll get an. Albert is a FinTech app that has lending, banking, and investing features all wrapped into a single app. With the Albert app, you can get your paycheck up to. Get a Klover cash advance up to $ cash – even if your payday is 2 weeks away. And unlike banks, there are no late fees, credit checks or interest charges. Get a paycheck advance with early direct deposit when you need it, because life doesn't always wait for payday. Woman stands beneath an open white umbrella and. EarnIn is a cash advance app available on both Apple and Android devices. It offers cash advances of up to $ per pay period and operates on a tip-based. But yes, you could go around to every cash advance app, get an advance and revoke debit/ACH authorization. They're legally required to comply. Now any day can be payday · Switch your payroll and qualify to get up to a $ Paycheck Advance. Paycheck Advance Disclosures. Paycheck Advance Disclosures. NOW AVAILABLE. MAJOR UPDATE. Get Cash Faster. Get cash even faster when you connect your bank account—money delivered the same day! App Privacy. See Details. Get cash advance in minutes with no interest. Request cash in seconds, and pay it back interest free. Join now for free! Online cash advances have made the emergency funding process much faster. If you're looking for a cash advance right away, apply with CashNetUSA. You'll get an. Albert is a FinTech app that has lending, banking, and investing features all wrapped into a single app. With the Albert app, you can get your paycheck up to. Get a Klover cash advance up to $ cash – even if your payday is 2 weeks away. And unlike banks, there are no late fees, credit checks or interest charges. Get a paycheck advance with early direct deposit when you need it, because life doesn't always wait for payday. Woman stands beneath an open white umbrella and. EarnIn is a cash advance app available on both Apple and Android devices. It offers cash advances of up to $ per pay period and operates on a tip-based.

Payday Loan Stores: While not ideal due to high-interest rates, payday loan stores are often open on weekends and can provide immediate cash. Be. Is a cash advance loan right for you? Complete your application online, or visit one of our stores to get started today. apply now. Cash Advance Loan. Not to mention, Avant is a cash advance app that allows users to get an instant $35, loan with a one to five-year payback period, even if their credit score. Our application is fast, easy, and totally secure. Apply today and get money in your account the same day! Our instant cash advance loans make it simple to get. A cash advance can help you pay your bills and cover other expenses. Download Gerald's cash advance app to get money fast. Sign up to get quick cash today. Get cash when you need it. With ExtraCash™ from Dave, you can get ExtraCash You agree to a settlement date when you take the advance. We don't. Is a paycheck advance app the same as a payday loan? Not quite, but they do have similarities. Paycheck advances and payday loans are small, usually $ or. Need cash quick? A cash advance online may be a viable solution. Apply for cash advance loans online up to $ through MoneyKey to potentially get help! Small loan—big help · Tap into funds whenever. It's a revolving line of credit, so you can access cash when you need it. · Pay it back on your terms. One size. Get the immediate cash you need and the respect you deserve from convenient and flexible alternatives to payday loans at Cash Store. Apply now! Get a Klover advance –– up to $ –– with no credit check. Get it now. Turn quick action into points. Earn points for things like taking surveys and watching. When things come up, apply for an Amscot Cash Advance* and get up to $ cash with no credit checks.** Cash Advance (also known as a payday loan) is fast. How can I get a cash advance online? · 1. Compare lenders · 2. Determine your maximum advance amount · 3. Calculate fees, interest, and penalties · 4. Complete your. Payday loans online at Check City are fast and secure. Apply in stores or online today with same day and instant funding options available. Net Pay Advance offers up to $ payday loans online same day to California residents. Instant deposit option. No hard credit check. Apply now! Spotloan is a better way to borrow extra money. It's not a payday loan. It's an installment loan, which means you pay down the balance with each on-time. ACE is a top payday lender. Get started today with our hassle-free application process by using the form below. Don't let a less-than-perfect credit score. Use Fast Cash's easy online application for your short term cash needs with approvals in less than 5 minutes and funds within 24 hours! With LoanNow, you can get a cash advance without maxing out your credit cards, risking family heirlooms or being trapped in endless payday loan debt. Get cash advance in minutes with no interest. Request cash in seconds, and pay it back interest free. Join now for free!

1 2 3 4 5 6