satire-theatre.ru

Market

Opening A Shared Bank Account

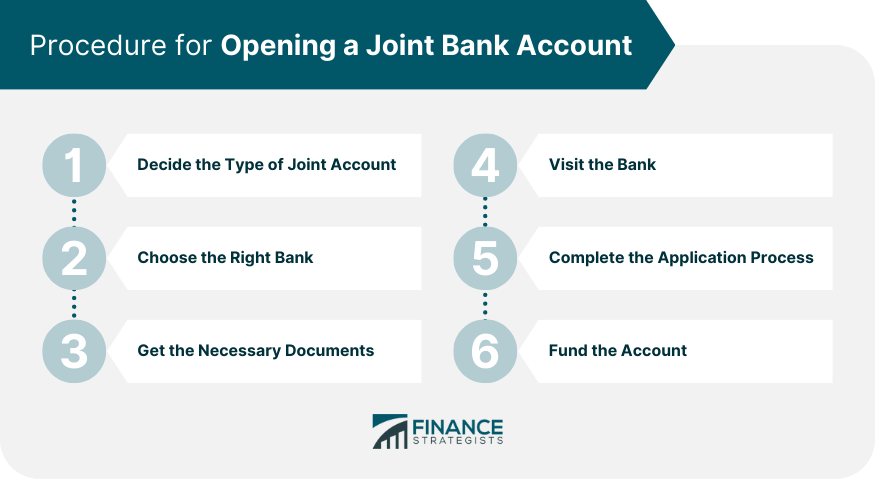

You will need to visit a CIBC Banking Centre, or speak to one of our representatives through telephone banking, to add your co-applicant during the account. How an existing Raisin customer adds a joint owner for a new deposit product · 1. Log in to your Raisin account, and select a product to fund. · 2. When prompted. How to open a joint bank account · Identification · Current address · Social Security number · Date of birth · Funds for an opening deposit. Most banks will. While not a requirement for opening a joint checking account, having a joint savings account is a great way for you and your partner to plan for the future. Regardless of where or how you open your account, you'll need to provide basic identification: driver's licenses, state IDs or passports. You'll also be asked. "In most instances, I advise newlyweds to fully merge their finances by opening joint bank accounts," He says. But if you keep an individual bank account open. How to Open a Joint Bank Account · Social security number/card · U.S. Government issued ID · At least one account holder needs to be at least 18 years old. A joint bank account can provide you and your partner, family member or friend, somewhere to deposit and store joint funds. Photo ID. Social Security number. Proof of address. Other general information, such as birth dates. Opening deposit (in some cases). You will need to visit a CIBC Banking Centre, or speak to one of our representatives through telephone banking, to add your co-applicant during the account. How an existing Raisin customer adds a joint owner for a new deposit product · 1. Log in to your Raisin account, and select a product to fund. · 2. When prompted. How to open a joint bank account · Identification · Current address · Social Security number · Date of birth · Funds for an opening deposit. Most banks will. While not a requirement for opening a joint checking account, having a joint savings account is a great way for you and your partner to plan for the future. Regardless of where or how you open your account, you'll need to provide basic identification: driver's licenses, state IDs or passports. You'll also be asked. "In most instances, I advise newlyweds to fully merge their finances by opening joint bank accounts," He says. But if you keep an individual bank account open. How to Open a Joint Bank Account · Social security number/card · U.S. Government issued ID · At least one account holder needs to be at least 18 years old. A joint bank account can provide you and your partner, family member or friend, somewhere to deposit and store joint funds. Photo ID. Social Security number. Proof of address. Other general information, such as birth dates. Opening deposit (in some cases).

To open a joint bank account or join an existing KeyBank checking or savings account, all account holders need to visit a KeyBank Branch together with a current. A joint bank account could be vulnerable to your spouse's creditors, while leaving your precious dollars in an individual account can protect them. To start on. Advantages of opening a joint bank account A joint deposit account is especially useful for couples and in situations where there is shared ownership and. Opening a joint checking account is very similar to opening an individual checking account. Select "joint account" when you fill out your application. SoFi joint bank accounts have no account fees, unlimited transfers, and up to % APY. See why SoFi was voted the Best Joint Checking Account of A joint account is a bank or brokerage account shared by two or more individuals. · Joint account holders have equal access to funds but also share equal. A joint bank account can provide you and your partner, family member or friend, somewhere to deposit and store joint funds. What information do I need to open a joint account? A joint savings account acts as a regular savings account, however, two or more owners have equal access. "In most instances, I advise newlyweds to fully merge their finances by opening joint bank accounts," He says. But if you keep an individual bank account open. Opening a joint account adds a financial link to the other person. This means companies will look at both of your credit histories as part of any credit checks. A joint account is a bank or brokerage account shared by two or more individuals. · Joint account holders have equal access to funds but also share equal. opened a joint bank account when we moved in together. I would classify it as having fully joined finances. All of the shared stuff (or non. CONS: · Lack of control. You cannot control how the other party spends your money. · A partner's debt could be an issue. Now that you are merged into one account. While it's oftentimes family members or business partners who choose to share accounts, you can open a joint account with anyone eligible. Each account holder. How to open a joint bank account · Choose a Chequing or Savings account. Review our Chequing and Savings accounts to decide which account type is the best fit. Account must be opened for a minimum of 35 calendar days · Account must be funded and have a positive balance · A single direct deposit of at least $ per month. Many joint banking accounts are started by couples who move in together, get engaged, or are married. The sharing of a bank account is a big step for most. Best joint bank accounts · Best for checking/savings combo: SoFi Checking and Savings · Best savings account: LendingClub LevelUp Savings · Best from a major bank. A joint bank account is simply a type of account that gives equal access to two people, making both parties responsible for the account.

Medical Exam For Term Life Insurance

Drinking can pose a potential health risk. Life insurance companies will check your application, driving record, and medical exam to get a picture of your. Most employees are eligible for FEGLI coverage. FEGLI provides group term life insurance. As such, it does not build up any cash value or paid-up value. It. The life insurance medical exam may include measuring your blood pressure, heart rate, height, and weight, and taking blood and/or urine samples. If you're. No medical exam for up to $2 million for qualifying applicants. Flexible and convertible coverage to permanent life policy during conversion period. Underwriting of your medical history and other factors may be required to determine whether you are eligible for coverage and, if so, what premiums would apply. Accelerated underwriting is no-med-exam coverage with a slightly different underwriting process than you'd see in other coverage types. Instead of requiring a. What does the medical exam check for? · Blood protein levels · Blood sugar levels · Fluid and electrolyte balances · Liver and kidney function · Metabolism · White. Why Term Life Insurance Requires a Medical Exam. Term life insurance aims to cover a specific term, usually 10 to 30 years. Most life insurance companies. Q. Do I need a medical exam for TD Term Life Insurance? A. Your sex, age, the amount of coverage you're applying for, your health status and medical history. Drinking can pose a potential health risk. Life insurance companies will check your application, driving record, and medical exam to get a picture of your. Most employees are eligible for FEGLI coverage. FEGLI provides group term life insurance. As such, it does not build up any cash value or paid-up value. It. The life insurance medical exam may include measuring your blood pressure, heart rate, height, and weight, and taking blood and/or urine samples. If you're. No medical exam for up to $2 million for qualifying applicants. Flexible and convertible coverage to permanent life policy during conversion period. Underwriting of your medical history and other factors may be required to determine whether you are eligible for coverage and, if so, what premiums would apply. Accelerated underwriting is no-med-exam coverage with a slightly different underwriting process than you'd see in other coverage types. Instead of requiring a. What does the medical exam check for? · Blood protein levels · Blood sugar levels · Fluid and electrolyte balances · Liver and kidney function · Metabolism · White. Why Term Life Insurance Requires a Medical Exam. Term life insurance aims to cover a specific term, usually 10 to 30 years. Most life insurance companies. Q. Do I need a medical exam for TD Term Life Insurance? A. Your sex, age, the amount of coverage you're applying for, your health status and medical history.

During the life insurance physical, the examiner will take a blood sample for testing and he or she will check your blood pressure and pulse. You probably know. The exam helps give the insurance company a basic snapshot of your overall health, so they can decide if you qualify for coverage—and how much that coverage. Accelerated underwriting is no-med-exam coverage with a slightly different underwriting process than you'd see in other coverage types. Instead of requiring a. No medical exam. You cannot be turned down because of your health. We can guarantee acceptance because of a two-year limited benefit period. This is permanent. A life insurance medical exam, sometimes called a paramedical exam, is a routine assessment of the applicant's health and family health history. Simply put, the exam for life insurance portion of the application process is used to determine if you have any health conditions that could affect your rate. Guaranteed issue, also called guaranteed acceptance, is a type of whole life insurance that has no medical exam or health questionnaire. Most insurers only. Yes, some insurers offer life insurance policies without a medical exam, usually called guaranteed issue or simplified issue policies. Mutual of Omaha, Fidelity Life and Transamerica offer the best no-exam life insurance policies based on our rating system. · More than 48% of the 1, life. The life insurance medical exam is meant to help your provider better understand your risk-level based on various health factors. It often involves tests like a. A life insurance medical exam is a physical exam performed by your insurer to assess risk. New York Life can guide you through what to expect and how to. You can get life insurance without an exam, though the premiums may be higher and the coverage more limited. No-exam policies are available as term life or. When you formally apply for life insurance, many potential insurers require a medical exam at no cost to you. It's a quick, simple process that usually. If you're over 60, your only option for high-coverage no-medical-exam life insurance is Penn Mutual. And regardless of your age, Penn Mutual is your only option. As a person gets older the examination limits start at lower amounts of insurance, but in general, an application for $, or more of life insurance will. No medical life insurance is a type of life insurance you can get without any medical details needed. You won't need to answer any health questions, undergo. You can get life insurance without an exam, though the premiums may be higher and the coverage more limited. No-exam policies are available as term life or. Guaranteed issue life insurance doesn't require you to submit to a medical exam or to answer any questions, and you can't be turned down for medical reasons. There are life insurance policies that don't require a visit to the doctor, lab work, or a great deal of paperwork — this is often referred to as no medical. Simply put, the exam for life insurance portion of the application process is used to determine if you have any health conditions that could affect your rate.

2 3 4 5 6